Balancing Vision and Delivery: Relationships in Financial Services

Northwestern Mutual (NM)'s digital products enable customers to make payments, view statements, and monitor their insurance policy values.

This work highlights a shift in the role that digital channels have played in NM's effective relationship-based planning process.

Impact

Role

Company Name

Timeline

Business Context

Northwestern Mutual elevated customer trust and retention through scalable self-service and relationship tools

Increase trust

The team strengthened NM’s reputation by bringing its brand look and feel into the mobile app, creating a unified experience across all platforms.

Show the product value

It helped clients see the full value of NM’s insurance, wealth products, and personalized planning from advisors.

Increase client and advisor collaboration

It boosted collaboration by allowing clients and advisors to work together directly on the platform.

Challenges

The team had to quickly align and collaborate in a high-stakes setting

Two squads with complimentary goals

Two teams worked side-by-side, one defined a long-term mobile vision, the other built toward it through iterative design. I guided the delivery team to turn vision into action, lead user research, and sharpen solutions before launch.

Regular check-ins and clear communication helped the teams stay aligned—despite working at different strategic levels in a fast-moving, high-profile setting.

Divergent business and user needs

The delivery team understood the importance of supporting users in accessing seamless self-service options. At the same time, they recognized how essential it was for the business to communicate the value of strengthening relationships.

Research and analytics revealed a chance to improve the vision, balancing user needs and business goals more effectively.

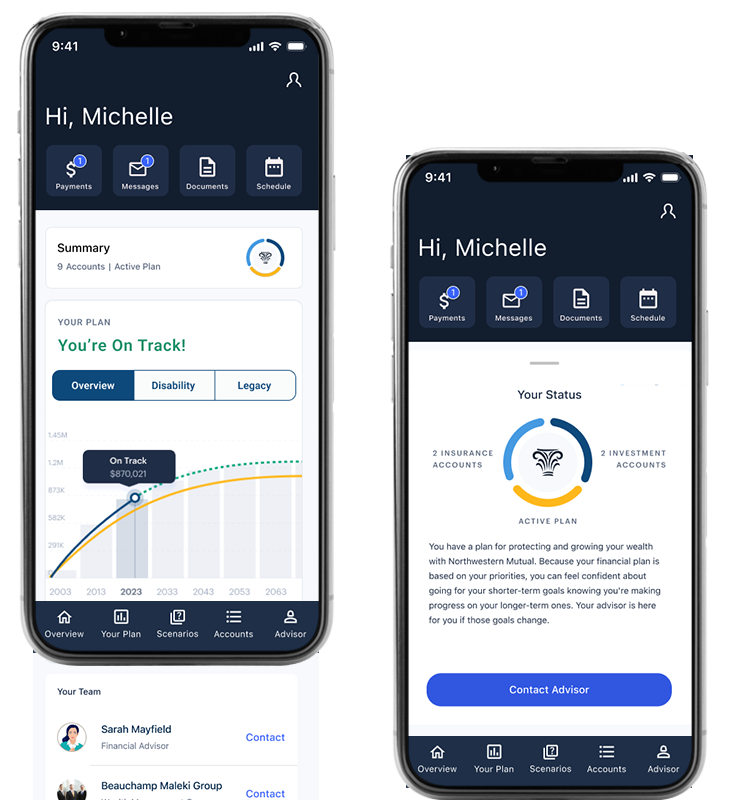

- Starting point: self-service tasks required too many clicks, making access inefficient

- Vision: create a centralized toolbar for quick, one-click access to top tasks, though early designs placed it too far down the page.

- Delivery: the toolbar now sits prominently at the top of the homepage, streamlining access and improving the user experience.

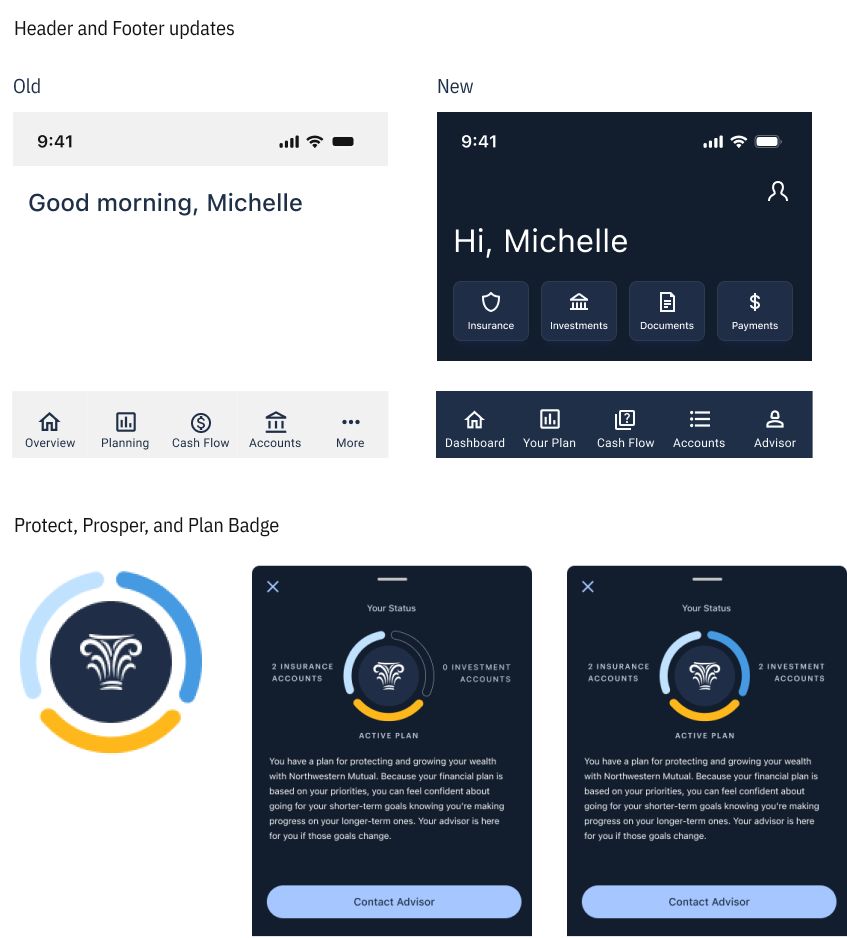

The first image was the existing design, the second image is the vision concept and the third image is the delivery concept.

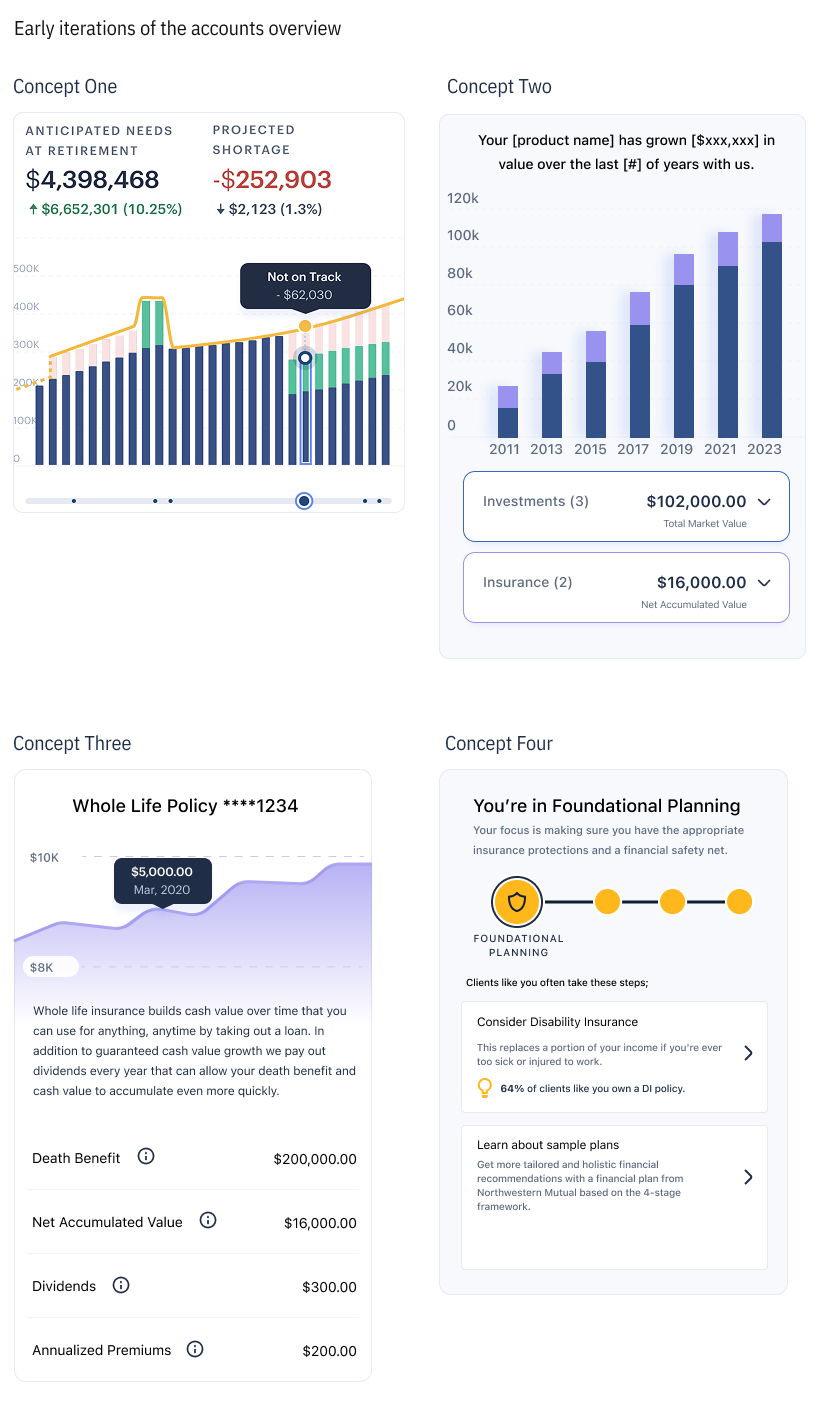

Communicating dense financial information

We had to make complex financial information easy to understand and show it accurately through design.

Additional resources were added to the team to fill in technical gaps, such as data visualization and marketing copywriting.

Research and insights

User research and a design system audit revealed clear opportunities for improvement

Brand design lacked consistency across touchpoints

We identified inconsistent brand design and elevated it, shaping the mobile design system to reflect the brand and build client trust.

Clients struggled to see product value clearly

We noticed that clients were not completely clear on the value of our products. Our goal was to help them feel confident with a mix of protection against disabilities, benefits for their future, and a clear view of how their investments are growing over time.

Advisors and clients relied on off-platform communication

NM thought that when clients are more involved with their plans and their advisors, they are more likely to continue working with NM. The app should be a real part of the client experience, making it easier for clients to stay connected and engaged.

Solution Overview

Three updates to the app were delivered following user research, technical review, and stakeholder input

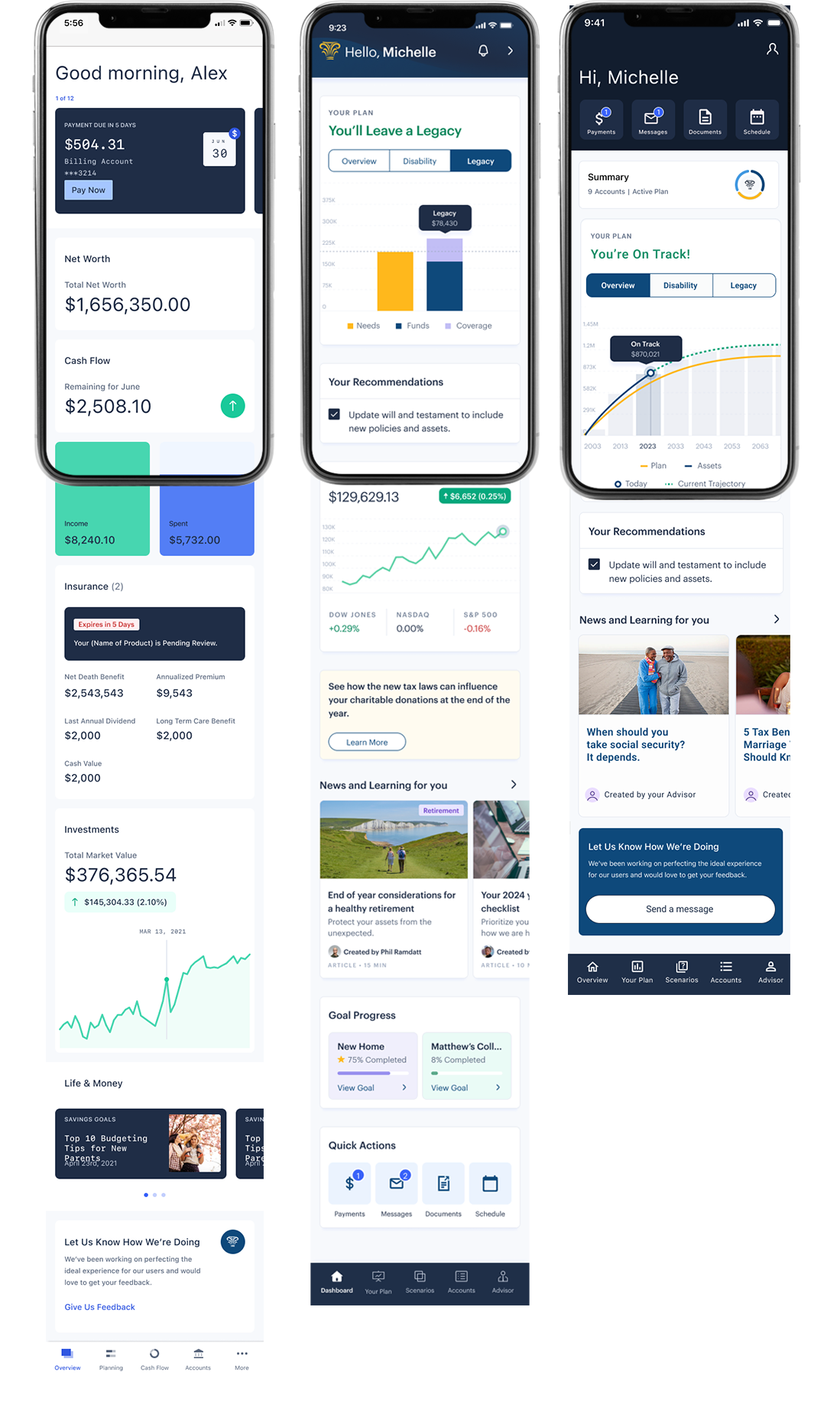

Elevating the Brand Experience

We introduced aspects of Northwestern Mutual's brand aesthetic into the mobile app.

- Brought in the dark NM blue globally with a heavy impact update to the header and footer.

- Introduced NM’s gold highlight color strategically to bring in more of NM”s familiar brand color.

- Created a “NM badge” to illustrate the NM three-part value proposition: protect, prosper, plan.

Clarifying Product Value

The account snapshot module shows product value and offers personalized recommendations to grow the client’s portfolio. This module appears below the quick actions toolbar.

Key Features & Capabilities

- Personal experience based on the client's product portfolio

- Brand moments that communicate the value of integrating new products

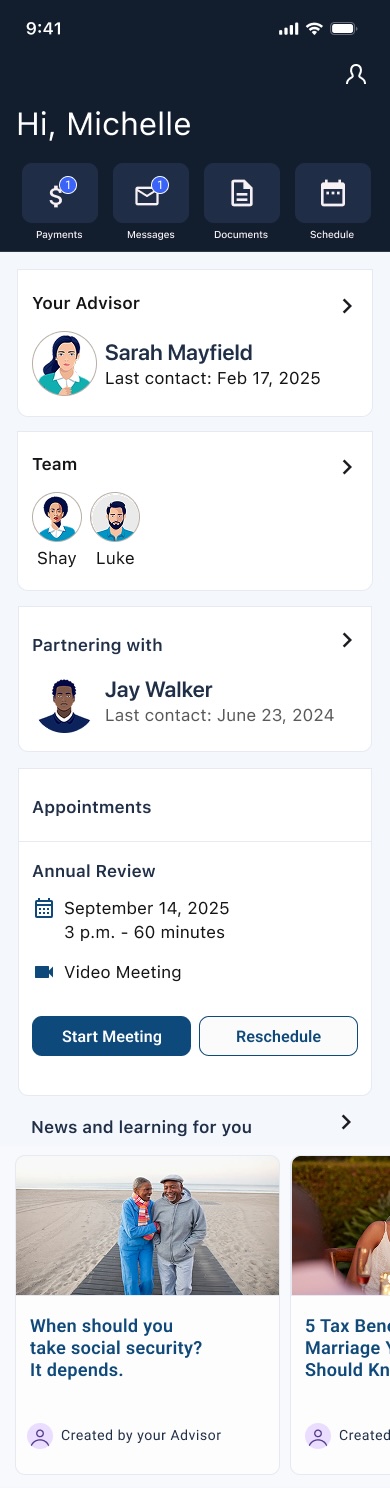

Enhancing Client–Advisor Collaboration

The advisor center empowers clients to seamlessly collaborate with their

advisor and financial team in a central location.

Key Features & Capabilities

- Secure in-app chat

- Easy access to documents

- Visibility into the full financial team

- Appointment scheduling

The team

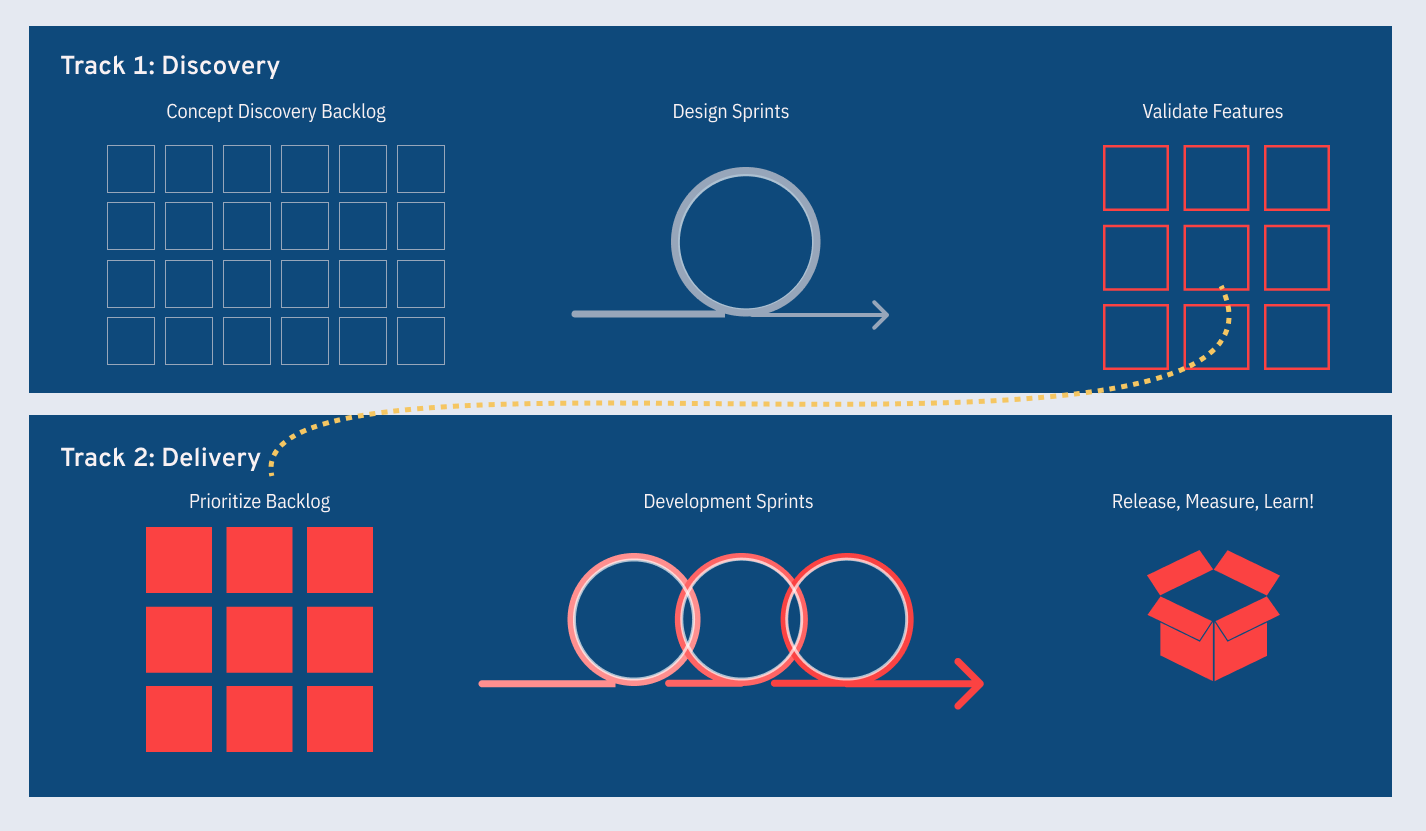

We approached the work with a dual track agile process. There were two teams: a discovery team and a delivery team

Vision team

3 Product Designers and a Design Director

Delivery team

4 Product Designers, a Content Designer, a UX Researcher, and a Design Director

My role

As the strategic coach to the delivery team, I fostered clarity, confidence, and cohesion in a high-stakes, fast-moving environment. I translated the long-term mobile vision into actionable design goals, empowering individual contributors to connect their work to broader business outcomes.

Through regular alignment rituals, collaborative critiques, and mentorship across roles, I helped the team sharpen their approach, guiding them to elevate both the self-service experience and relationship-driven interactions.

Let's Work Together

.png)